Banking & Finance

Sbi Zero Account Opening : स्टेट बैंक में घर बैठे जीरो बैलेंस खाता खोलें मिलेगा सरकारी योजना का लाभ 2022

दोस्तों अगर आप स्टेट बैंक ऑफ इंडिया यानी SBI में अपना अकाउंट खोलना चाहते हैं या जीरो बैलेंस अकाउंट ओपन करना चाहते हैं तो आज के इस आर्टिकल में हम आपको बताने वाले हैं कैसे SBI ONLINE OPEN ZERO BALANCE ACCOUNT घर बैठे हैं अपना एसबीआई का जीरो बैलेंस अकाउंट के लिए अप्लाई करके अपना बैंक अकाउंट घर बैठे कैसे खोल सकते हैं। इस आर्टिकल में हम आपको जो प्रोसेस बताने वाले हैं उस प्रोसेस में आपका जो अकाउंट नंबर है वह आपको तुरंत ही मिल जाता है और साथ ही साथ आपको एसबीआई का इंटरनेट बैंकिंग भी और एसबीआई का एटीएम कार्ड भी आपको साथी साथ मिल जाता है।

Features : Insta Plus Savings Bank Account

- Open your SBI Insta Plus Saving Bank Account through Video KYC.

- Paperless account opening and no branch visit needed.

- Only Aadhaar details & PAN(Physical) required.

- Customer will be able to transfer funds using NEFT, IMPS, UPI etc. through YONO app or Online SBI i.e. Internet Banking.

- Rupay classic card will be issued.

- Experience 24*7 banking access through Yono app, internet banking and mobile banking.

- SMS Alerts, SBI Quick Missed call facility available.

- Facility of transfer of accounts through Internet Banking channel.

- Nomination facility is mandatory.

- Signature will be captured during Video KYC process. Customer can apply for cheque book through YONO/INB/Branch after account is successfully opened.

- Passbook will be issued if requested by the customer.

- Charges for all other services will be in accordance with extant service charges applicable to Regular savings bank account.

Eligibility :

- Resident Indians above 18 years of age and who are literate.

- New to bank customer and does not have a CIF with SBI. In case customer has any active relationship/CIF with the bank, she/he is not eligible for this account.

- Mode of operation allowed is only “Single”.

Also Read : Instant Personal Loan

Documents Requirement :

- Physical (Original) PAN and Aadhaar number are mandatory.

- Aadhaar bears the current address of the customer and mobile number as submitted in Aadhaar details must be in possession of the customer as OTP will be triggered on the same number.

- Mobile number is mandatory.

- Customer should be physically present in India during the complete account opening process.

How to open SBI Insta Plus Savings Account ?

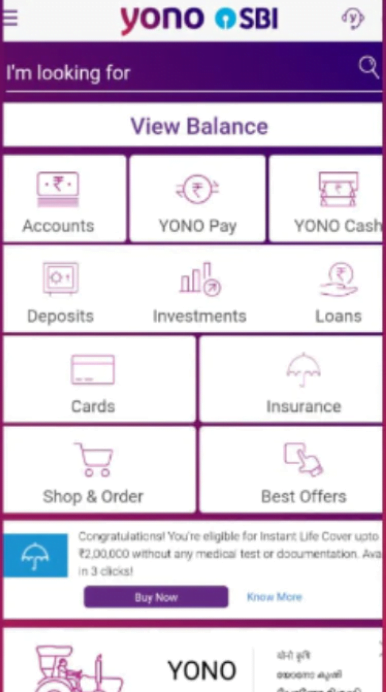

- Download YONO App

- Click New to SBI—Open Savings Account → Without Branch visit→ Insta Plus Savings Account

- Enter your PAN, Aadhaar details

- Enter OTP sent to Aadhaar registered mobile number.

- Enter other relevant details

- Schedule Video Call

- Login to the YONO App at the scheduled time through Resume and complete the Video KYC process

- Your Insta Plus Savings account will be opened, Account will be activated for debit transactions after verification by Bank Officials.